Feeling Fortunate

An Update Amid Significant Market Volatility

I don't usually send out updates this frequently, but given today's substantial market decline—the worst since the volatility of 2020—I felt compelled to address the current investment landscape and share how Asymmetric Edge's portfolio is holding up. While I wouldn’t claim to have predicted this correction, I’m grateful the strategy was already positioned in more defensive assets to help weather the turbulence. As it turned out, the portfolio even managed to close slightly positive today.

Today's plunge was driven primarily by the broad-based implementation of tariffs, resulting in sharp declines across multiple asset classes.

How a Momentum-Based Strategy Helped Mitigate Losses

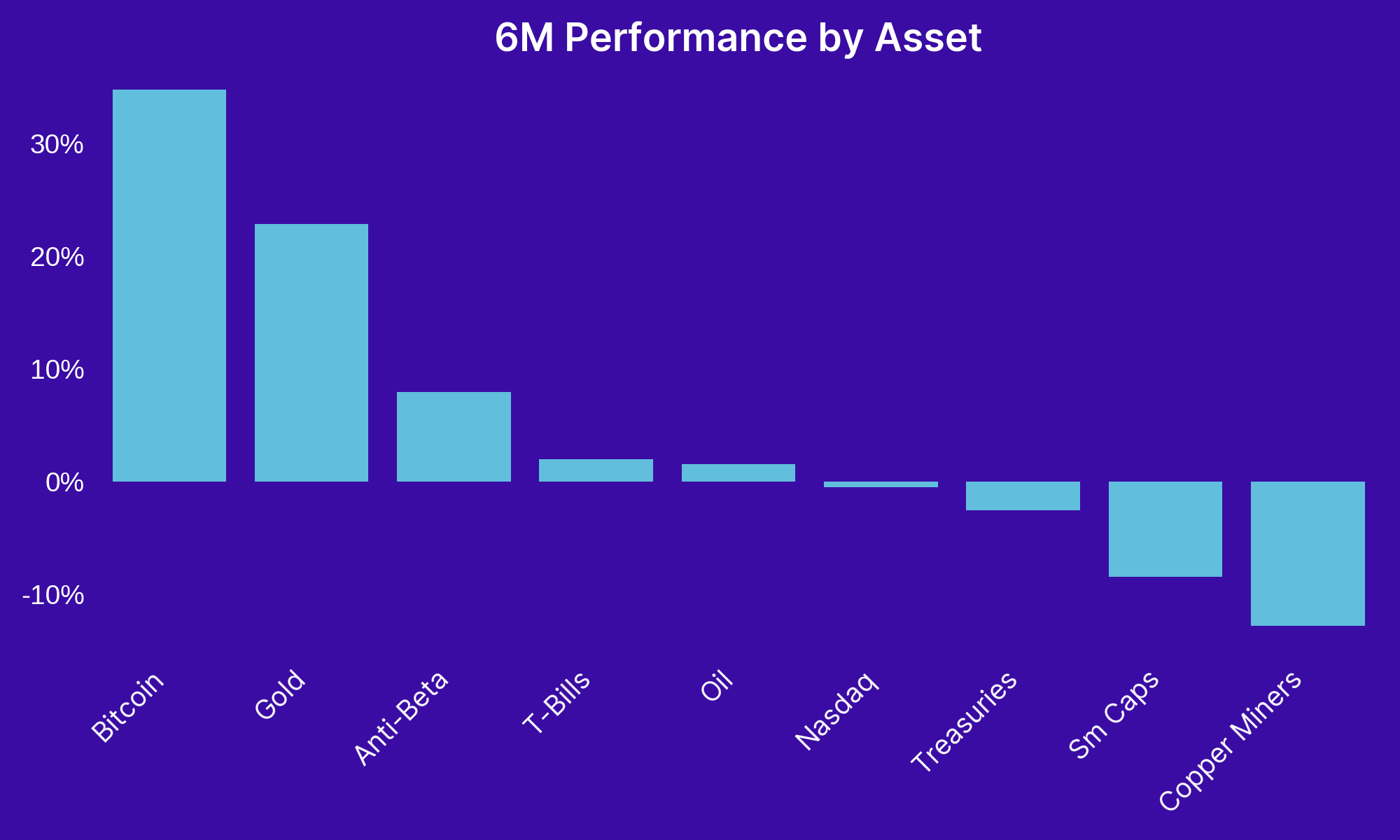

Many of the asset classes hit hardest today, such as small-cap stocks and tech stocks, had already shown signs of weakening momentum in recent months. Momentum-based investing (which is a core part of Asymmetric Edge's portfolio strategy) focuses on identifying assets with strong recent performance, based on the idea that those trends may continue in the near term.

For instance, over the past six months, both the Russell 2000 (small caps) and the NASDAQ (tech-heavy) had lost momentum and fallen in the rankings. At the same time, more defensive assets like today’s top-performing anti-beta strategy (BTAL) had moved up. This kind of shift is exactly what momentum strategies aim to capture. By rebalancing more frequently (monthly instead of quarterly) these strategies help reduce exposure to struggling assets before steep losses occur.

Today's Market Numbers: A Sobering Reality

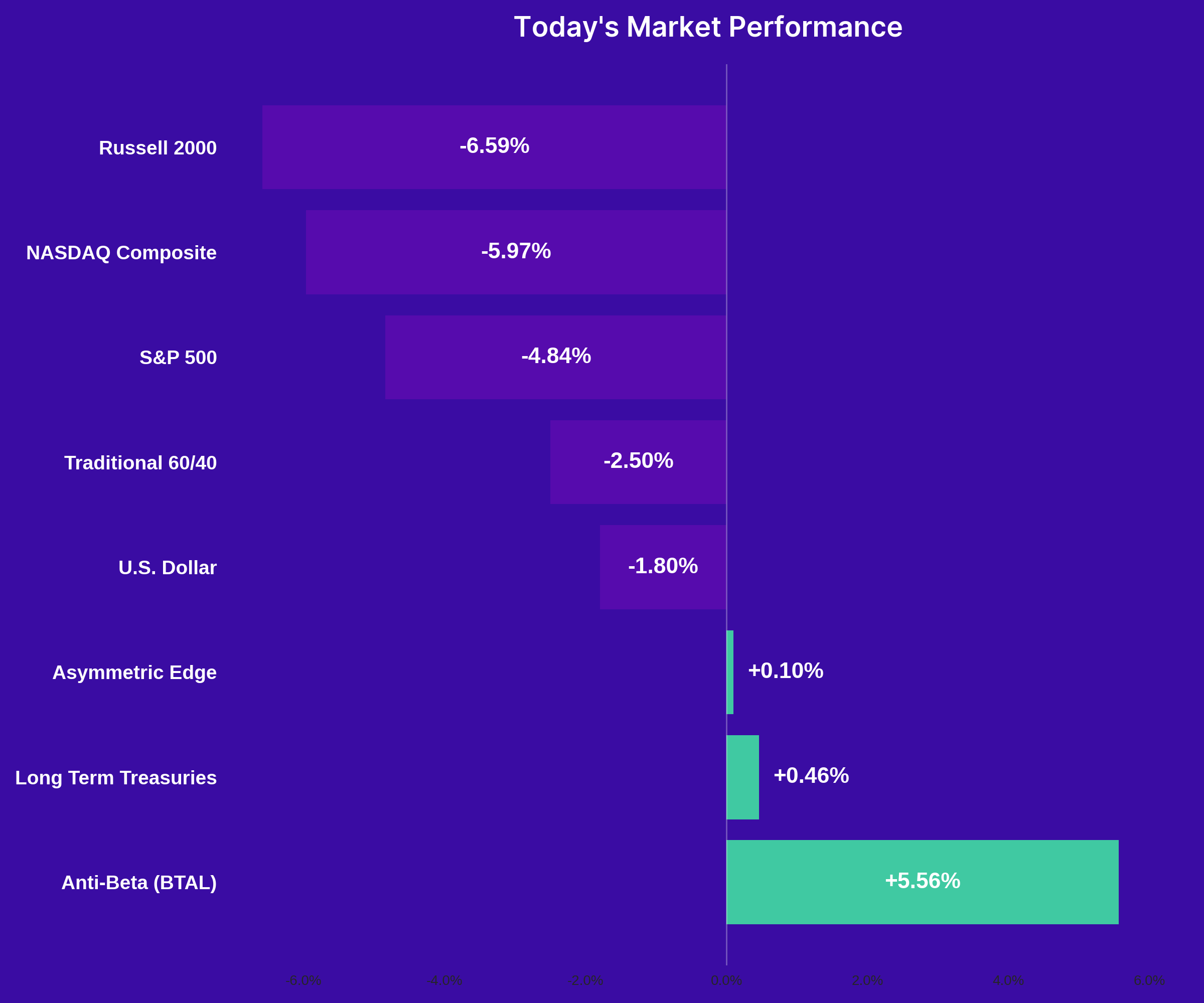

While it's important not to overreact to a single day's market performance—typically, it takes a few days for major market-moving news to be fully priced in—today's moves stand out due to their extreme nature.

Today's figures highlight just how challenging the environment has become:

- Russell 2000: -6.59%

- NASDAQ Composite: -5.97%

- S&P 500: -4.84%

- Traditional 60/40 Portfolio: -2.5%

- U.S. Dollar: -1.8%

- Asymmetric Edge: +0.10%

- Long Term Treasuries: +0.46%

- Anti-Beta Hedge (BTAL): +5.56%

The Pressure on Investors Nearing Retirement

These numbers are especially concerning for retirees or those approaching retirement, who often carry heavier-than-recommended exposure to equities. Vanguard's 2024 "How America Saves" report indicated the typical investor aged 60-64 holds about 60% of their portfolio in stocks, far higher than the traditional "100-minus-age" guideline (which would suggest about 35% for a 65-year-old). This allocation mismatch creates substantial risk in volatile markets.

Facing the Risk of Stagflation

The current environment raises fears of potential stagflation—stagnant economic growth paired with persistently high inflation. This combination is notoriously difficult to manage, as traditional inflation-fighting measures (raising interest rates) could further weaken economic growth, while stimulating growth (lowering interest rates) could intensify inflation.

The Importance of a Disciplined, Diversified Strategy

No one, including myself, knows exactly how this situation will unfold. This uncertainty highlights the importance of adhering to a disciplined, rules-based investment strategy designed to navigate market cycles. My personal approach uses momentum strategies, systematically shifting out of assets losing momentum and into those demonstrating strength.

As Nobel laureate Harry Markowitz famously noted, "Diversification is the only free lunch in investing." Maintaining a diversified portfolio across various asset classes helps manage risk while preserving opportunities for returns.

Staying Optimistic and Focused on Opportunities

During times of market distress, negativity often dominates the conversation. Yet, I've always appreciated the saying, "Bears sound smart, but bulls make you money." - Ed Yardeni. Historically, the market has trended upwards despite periods of significant downturn, including events like the tech bubble, the Great Recession, and the COVID crash. Rather than succumbing to negativity, maintaining an optimistic yet realistic outlook tends to serve investors well in the long run.

Lessons Learned: Avoiding the Temptation to Short or Panic Sell

Reflecting on my early investment experiences, I learned firsthand that strategies like shorting stocks—betting against the market—are extremely risky. Given that markets historically rise about 70% of the time, aligning with the natural upward momentum generally produces better outcomes than attempting to profit from declines or panicking by selling everything during downturns.

In my experience, consistently staying disciplined, diversified, and focused on long-term objectives has provided substantial benefits over time.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.