Sometimes Boring is Good

Welcome to the first edition of this newsletter! Within these pages, I'll share my perspective on investment strategies and the valuable insights I've gained throughout my career. Since dedicating myself full-time to investing in 2018, I've accumulated roughly eight years of hands-on experience. I'll regularly discuss the thinking behind aspects of my personal portfolio construction. The newsletter will take an educational approach, exploring how to integrate key concepts including relative strength, momentum analysis, asset correlation, and various weighting methodologies to help you develop a more sophisticated investment framework.

March's Portfolio Performance

Last month's performance was pretty uneventful, with most of the portfolio sitting in T-bills (Treasury bills). This reflected the model's strong risk-off stance at the time. The portfolio model works by selecting the top 4 performing assets out of 9 different asset classes, using a specific lookback period. Whenever T-bills make it into the top 4, they end up dominating the portfolio because of the unique asset-weighting model I use.

The portfolio uses a risk parity approach to determine asset allocation, which means it balances risk contribution across assets rather than just dividing money equally. Since T-bills are considered among the safest assets in the world, their risk contribution is tiny—so they end up taking up a much larger portion of the portfolio. The T-bill ETF I use contains T-bills with maturities ranging from between one to three months, making them very short-term. This short duration means they're less affected when interest rates change (unlike longer-term bonds that lose value when rates rise). BIL is currently yielding a respectable 4.13% (as of late March 2025), which isn't bad for such a low-risk investment.

March Performance Overview

- Asymmetric Edge +0.03%

- Gold +7.9%

- 60/40 -2.3%

- S&P 500 -6.17%

- NASDAQ - 7.72%

Gold Continues to Shine

Gold continued its impressive run in March, breaking through the $3000 an ounce milestone. What's interesting is that gold has actually outperformed the S&P 500 this century (since 2000). Gold played a major role in the portfolio's strong showing last year, often making up at least 40% of the holdings during many months.

While gold's performance is certainly nice for those following this portfolio approach, it's worth noting that gold typically rises for less-than-ideal reasons: geopolitical tensions, currency devaluation, and general uncertainty. It's been a store of value for thousands of years, and surprisingly to many skeptics, continues to serve that function today—perhaps even more effectively. Central banks are a significant factor in gold's recent surge, particularly with countries like China purchasing substantial quantities and driving up prices.

March Portfolio Outlook: Still Playing Defense

Going into April, portfolio allocations remain largely unchanged from last month. I'm still heavily positioned in T-bills for the same reasons mentioned earlier. The portfolio has actually moved even further into the risk-off category with the addition of BTAL, which operates as an interesting long-short fund.

BTAL employs a distinctive strategy—it takes short positions in high-beta stocks while simultaneously establishing long positions in low-beta stocks. Beta measures how much an individual stock moves in relation to overall market movements. This approach tends to perform well during market downturns, providing a cushion for portfolios.

The strategy capitalizes on a common investor behavior pattern: many investors, particularly individuals who cannot use leverage, often gravitate toward high-beta stocks as a perceived means of achieving higher returns (think TSLA). By overweighting these riskier stocks, they create an effect similar to leverage. This increased demand can cause high-beta stocks to become overpriced, potentially leading to lower risk-adjusted returns in the future. Meanwhile, lower-beta stocks may become relatively undervalued. This creates a potential arbitrage opportunity for investors who go long on low-beta stocks and short high-beta ones. BTAL takes advantage of this opportunity within a straightforward ETF, offering a way to profit during market downturns.

My Portfolio Management Approach

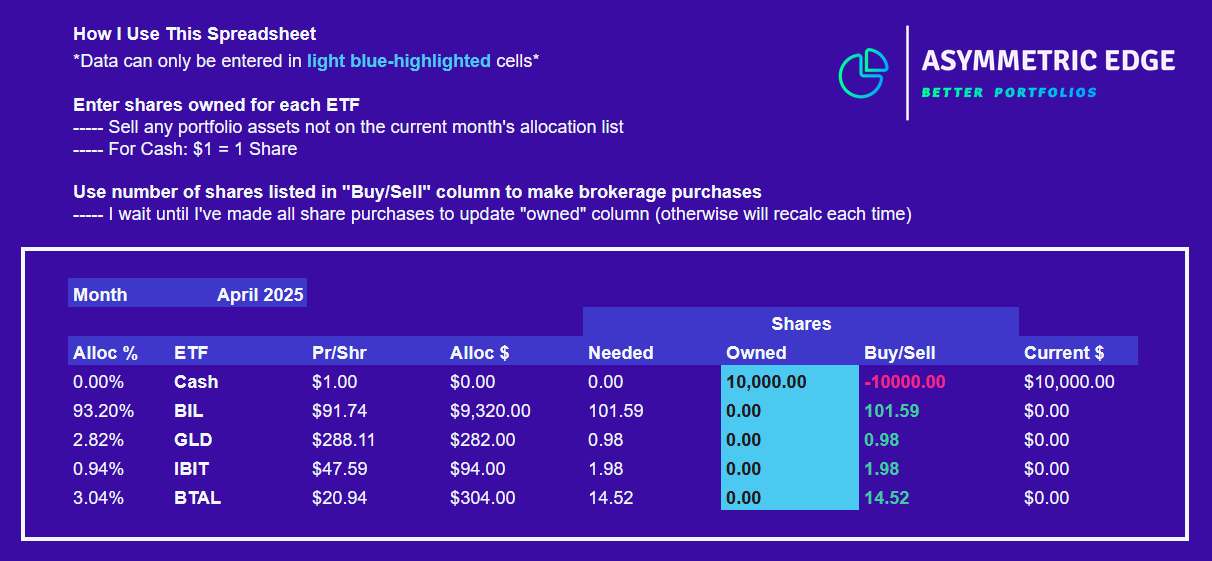

For portfolio allocations, I use a Google Sheets spreadsheet to calculate the number of shares needed to achieve target allocation weights. I don't worry about entering the exact number of shares, as being off in my allocations by +/- 1% will make little difference in portfolio performance. Many beginners don't realize they can purchase fractional shares (e.g., 4.56 shares of BIL). This ability is particularly valuable for smaller accounts, as it allows investors to get closer to their target allocation weights, which might not be possible using only full shares.

Following Along

Take a look at my April allocations, below. I've already updated all the allocation changes, and the calculations based on share prices refresh in real time. Simply click the link to use the spreadsheet yourself.

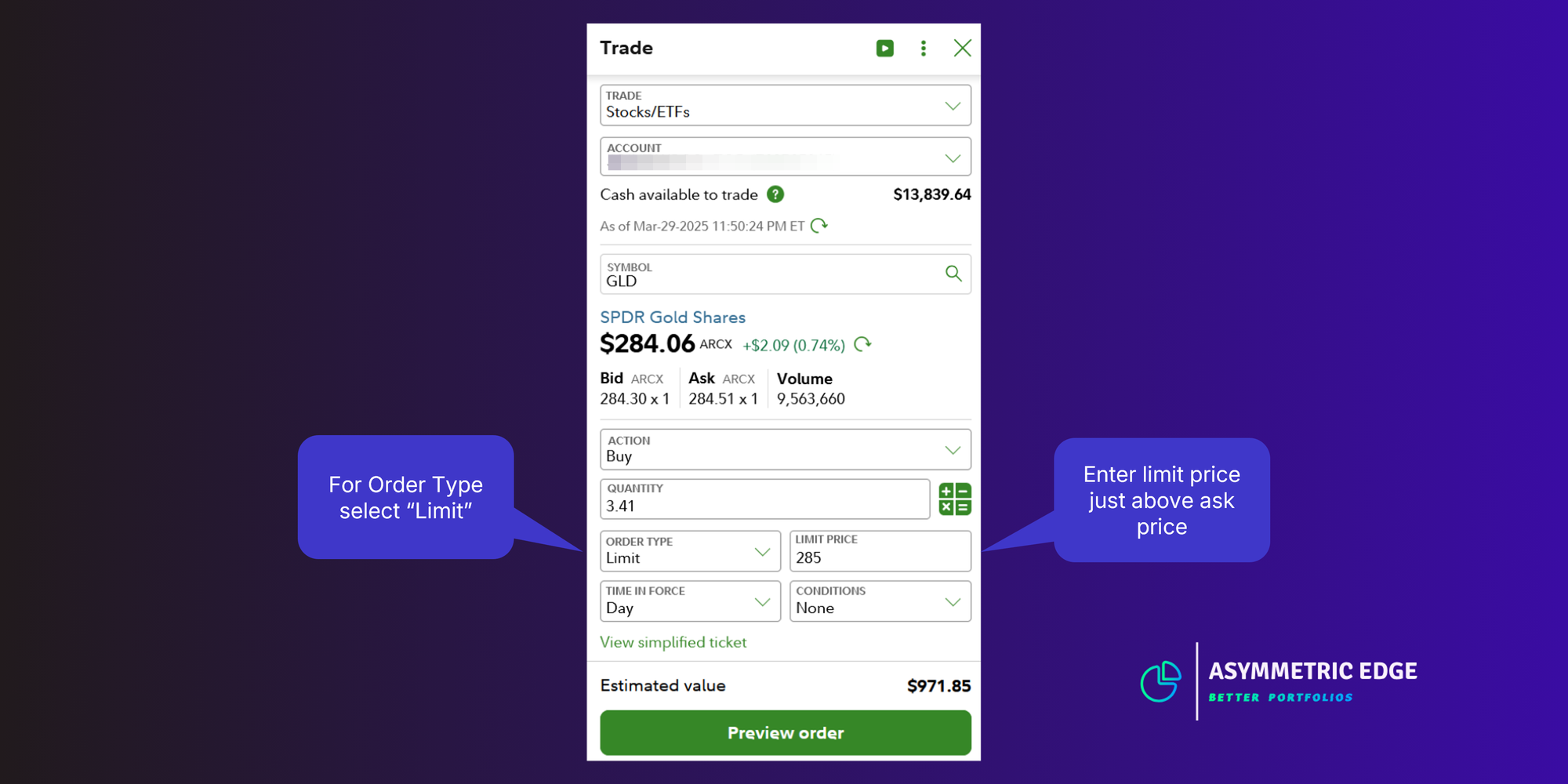

I make sure to use limit orders, especially with ETFs that have lower liquidity. BTAL is particularly notorious for limited liquidity, making limit orders essential to avoid overpaying.

For long-term investment success, minimizing discretionary decisions is crucial. A detailed system that clearly outlines the actions to take in various scenarios ensures clarity and consistency. Establishing a set schedule for portfolio rebalances, defining specific rules for position selection and allocation, utilizing a thoroughly backtested system, and diversifying across multiple asset classes all work together to optimize the probability of positive outcomes each month.

This systematic approach helps reduce anxiety and prevents impulsive decisions that deviate from the established strategy. Many investors find this structure helps them avoid costly mistakes that arise from emotional reactions--I can speak from personal experience and tell you that having a solid system has been a game changer. Choosing a specific, consistent day for monthly rebalancing adds another layer of discipline. While some prefer the first day of the month, rebalancing on the final trading day of the month (ideally 1-2 hours before market close) works best for me.

Portfolio Strategy Fundamentals

Every month in this newsletter, I will explore different aspects of portfolio construction and strategy. To give you a basic overview, the key elements that make up this approach include: using assets that are as uncorrelated as possible, applying relative strength and momentum principles, implementing risk parity weighting, including a specific number of portfolio assets each month, and following an optimized rebalancing schedule.

Why I Prefer Sortino Ratios

It's worth noting that I have optimized this portfolio to achieve the highest Sortino ratio possible. Sortino ratios are less commonly known than their counterpart, Sharpe ratios. A Sharpe ratio evaluates a portfolio's performance by examining both its return (say, an average 7% annual return) and its overall volatility (the ups and downs over time).

Sortino ratios take a different approach by not penalizing upside volatility—after all, few investors complain when their portfolio rises too quickly! Instead, Sortino ratios focus specifically on evaluating whether you're being appropriately compensated for the downside risks you accept. Rather than factoring in all volatility, this metric concentrates solely on negative returns that fall below your target threshold. This helps determine if the potential gains truly justify the possibility of losses, instead of simply measuring overall volatility.

In Search of Maximum Diversification

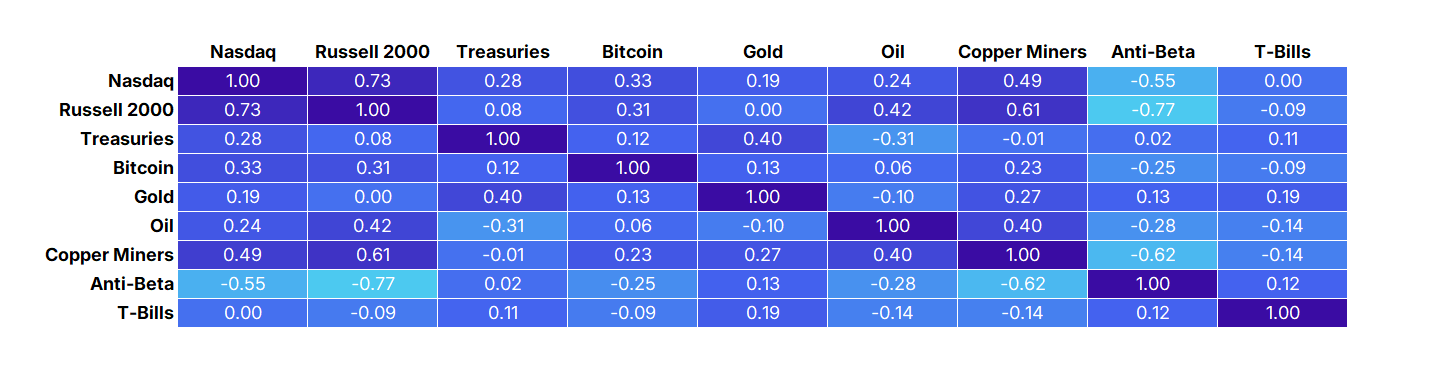

The portfolio contains nine distinct asset classes that aim to provide meaningful diversification. Finding truly uncorrelated assets in today's investment landscape presents a significant challenge. While these assets maintain low correlation under normal conditions, it's important to recognize that during extreme market stress (like February 2020), correlations can temporarily converge toward 1.0 as investors indiscriminately sell assets to raise cash. These correlation spikes typically resolve quickly as markets settle down.

The portfolio incorporates a diverse mix of stocks, bonds, cryptocurrency, and commodities. The 36-month rolling correlation table demonstrates the relationships between these assets. The anti-beta strategy (BTAL) shows particularly promising negative correlations with most other asset classes—an ideal characteristic for diversification.

The Importance of Going Beyond Stocks & Bonds

The included chart comparing the S&P 500 with 12-month rolling correlation to long-term treasuries (TLT) challenges conventional wisdom. While many investors assume treasuries move opposite to stocks, this relationship has notably broken down during certain periods, particularly in 2022 when bonds provided minimal protection against stock market volatility. The chart's red intensity indicates correlation strength, highlighting why diversification beyond traditional stocks and bonds remains essential to this portfolio strategy.

Thanks for Joining Me!

If you've made it this far, thank you for spending some of your valuable time reading my work. I strive to produce information-rich content that makes it worthwhile. I firmly believe everyone is capable of managing their own money. For far too long, money managers have obfuscated and overcomplicated investing. I believe there's a better approach, and I look forward to sharing more of what I've learned in the coming months. Thank you!

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.