Staying Ahead in a Shaky Market

Today's Agenda:

- If your portfolio took a big hit, is it too late to switch strategies?

- An overview of volatile markets this month

- Performance update for Asymmetric Edge's portfolio

- Shifting effectively between offensive and defensive strategies

Note: The following content is for informational and educational purposes only and does not constitute personal investment advice.

Is It Too Late to Change Your Portfolio Strategy?

No, I don't think it is. Many investors with traditional investment accounts have seen significant declines recently. Historically, strategies similar to Asymmetric Edge's have found optimal entry points after market downturns. This strategy positions itself to rotate into aggressive, growth-focused assets when the market rebounds. The real issue occurs when investors sell after a decline without having a clear strategy for re-entry.

Risks of Buy-and-Hold Investing

With a standard buy-and-hold strategy, you simply hold your positions and wait for market recovery. This method has generally succeeded since the 1980s but was problematic during earlier periods like the 1970s and 1930s.

The 1970s experienced stagflation (simultaneous inflation and weak economic growth), negatively impacting stock market returns. Investors needed exposure to gold and commodities—particularly oil—to maintain portfolio growth. Similarly, if an investor bought in 1929, they would have had to wait until 1954 for the stock market to surpass its previous highs.

The common wisdom to buy stock market dips is relatively new and would have led to bankruptcy multiple times between 1929 and 1980. While passive indexing (investing in benchmarks like the S&P 500) is popular today, history shows that such strategies can struggle significantly in challenging periods.

The key to superior portfolio returns is to make surprisingly large allocations to alternative assets that perform when stocks and bonds do not. - Chris Cole

The current heavy focus on stocks and bonds reflects recency bias. Historical data emphasizes the importance of diversifying into alternative assets. Investors could benefit from broadening their portfolios beyond conventional assets to enhance future performance.

Historically, the Asymmetric Edge portfolio has successfully identified opportunities in difficult markets, although past performance does not guarantee future results.

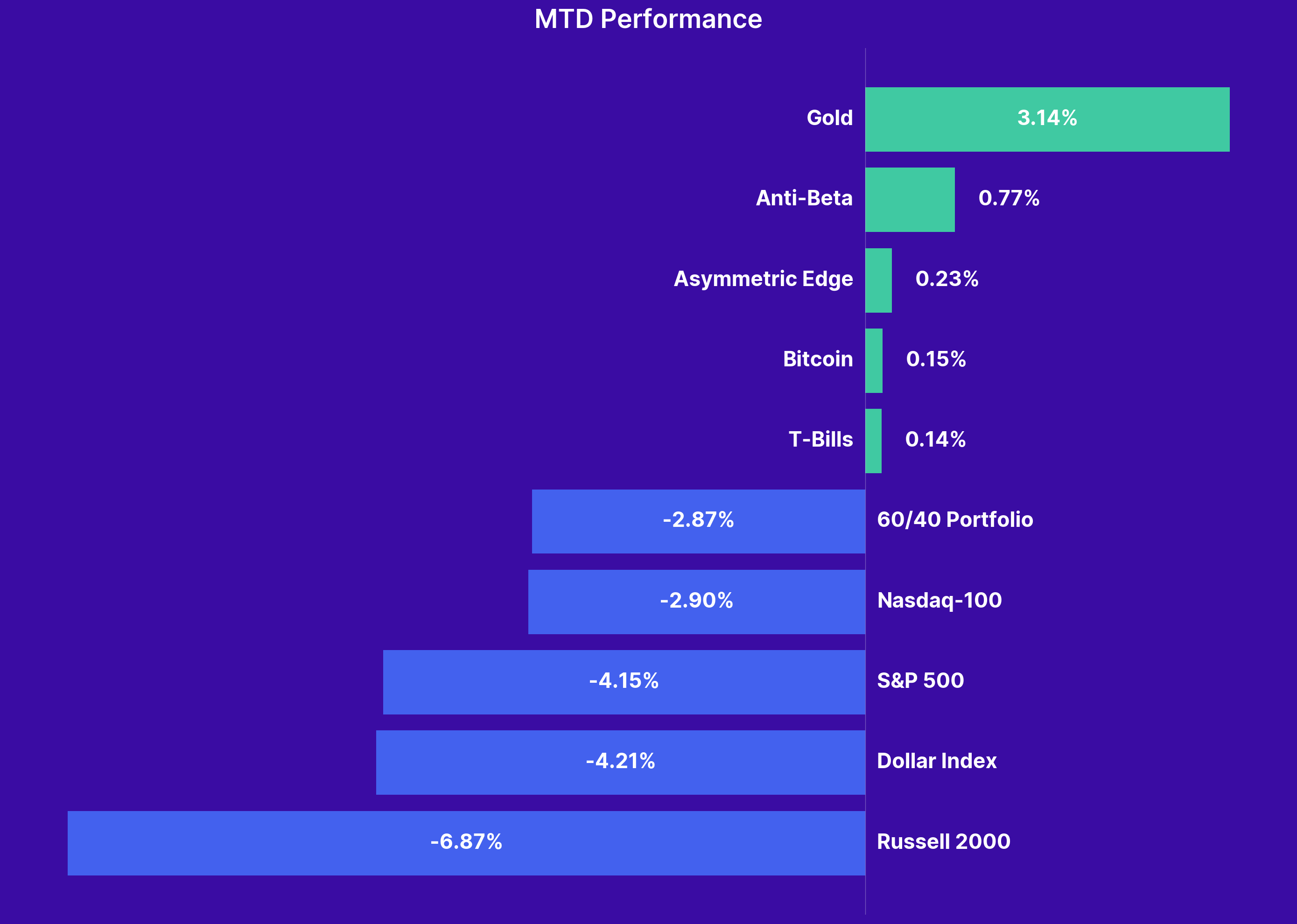

Asset Performance This Month

This month has been volatile, characterized by substantial stock market swings due to changing tariff policies and heightened uncertainty. The Russell 2000 index—seen as reflective of the U.S. economy—declined -6.87% month-to-date. Meanwhile, the S&P 500 fell by -4.15%, and a typical 60/40 portfolio declined -2.87%.

Managing risk effectively during market stress is essential. Notably, the only positive-performing assets this month have been those included in the Asymmetric Edge portfolio. Although the portfolio has weaker months, this highlights the effectiveness of momentum-based portfolio construction.

Reminder: Past performance is no guarantee of future results. Always consider your personal financial circumstances when evaluating market information.

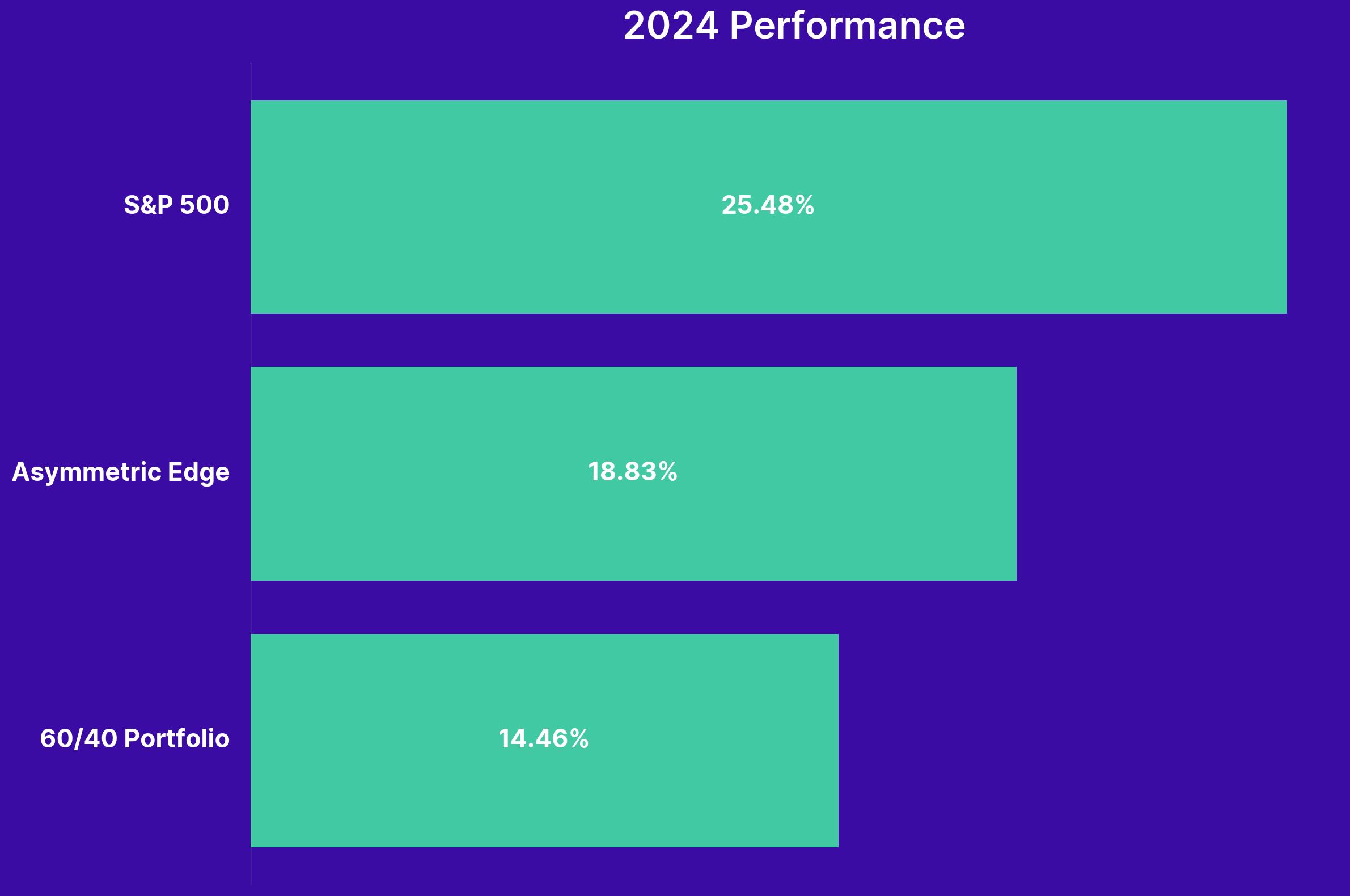

Portfolio Performance This Year

As of April 11, 2025, the Asymmetric Edge portfolio has outperformed traditional benchmarks, beating a 60/40 portfolio by 5.18%, the S&P 500 by 10.82%, and the Nasdaq-100 by 13.44%.

Performance Last Year

The portfolio has effectively managed downturns in negative market environments, showcasing defensive strengths. But can it also perform aggressively during strong markets? Absolutely—while still controlling downside risk.

Optimizing Reward vs Risk

In 2024, the portfolio's maximum drawdown was -2.64%, significantly better than a traditional 60/40 portfolio’s -3.66%. It also delivered superior risk-adjusted returns, achieving a remarkable Sortino Ratio of 2.84. A Sortino Ratio above 1 indicates a strong balance between returns and downside risks, and 2.84 is exceptional.

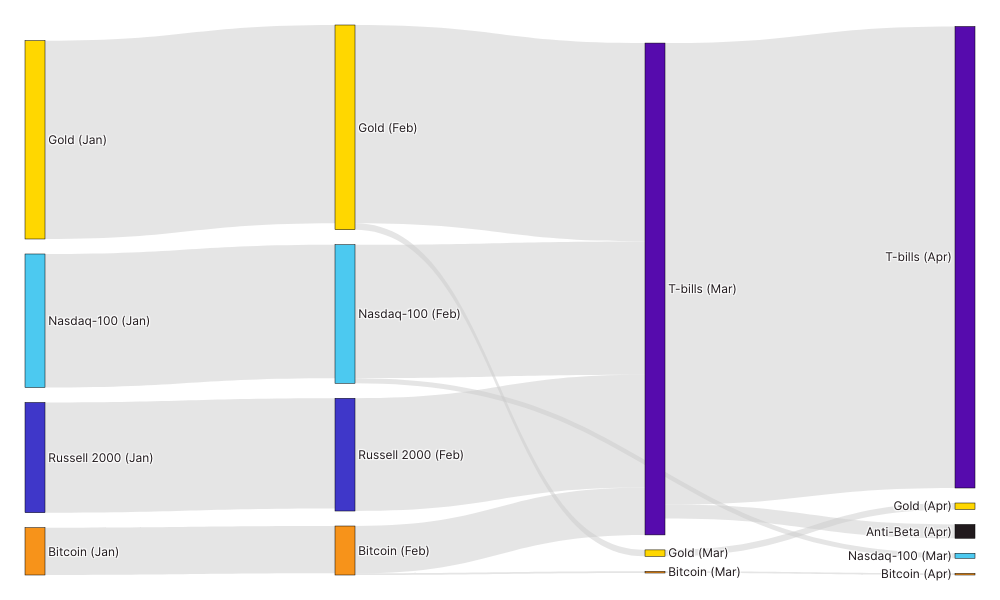

A Highly Adaptive & Responsive Approach

The portfolio stands out due to its adaptability, shifting between aggressive and defensive positions as the market evolves. The Sankey chart above illustrates that in January and February, roughly 60% of assets were allocated to risk-on positions. As market momentum waned, the strategy shifted almost entirely to safe assets like Treasury Bills (BIL).

Minimal Drawdowns

The strength of this approach lies in its ability to effectively manage market downturns. Historical backtests show minimal drawdowns (around -6%), consistently outperforming traditional benchmarks like the S&P 500. Monthly rotations strike an ideal balance between responsiveness and allowing enough time for potential market rebounds. Quarterly rebalancing tends to perform worse in tests, and more frequent adjustments risk locking in losses prematurely.

Disclaimer: This newsletter is a personal publication intended solely for educational and informational purposes. It is not personalized financial advice or an investment recommendation. Please perform your own research and consult a qualified professional advisor when making investment decisions. Past performance discussed is not indicative of future results.